Steps taken to end non-transparent credit culture in country, says PM Modi | India News – Times of India

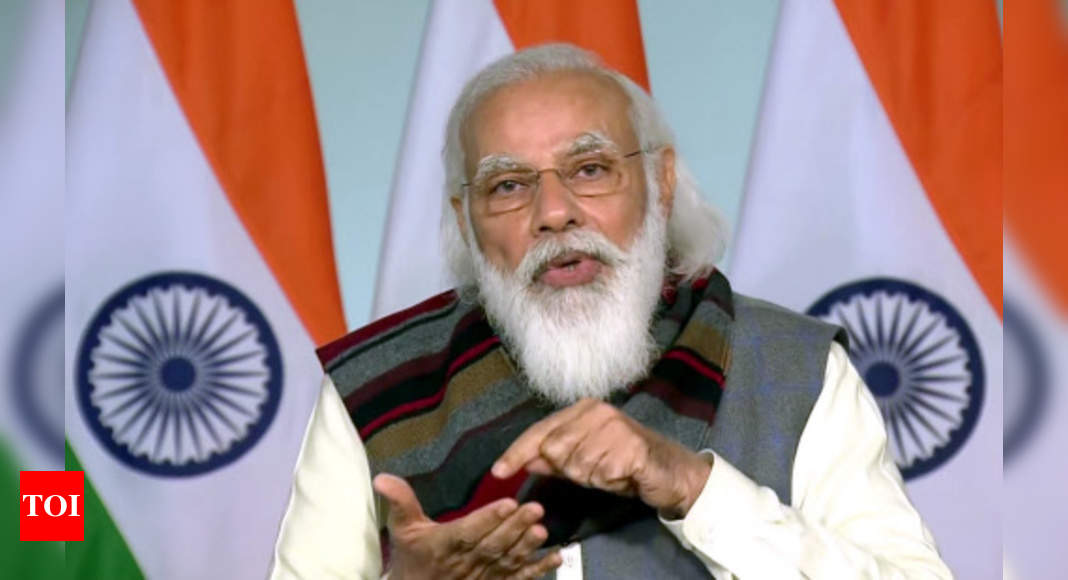

NEW DELHI: The country’s financial and banking sector was weakened in the name of aggressive lending about 10 years ago, but the BJP-led central government has taken several steps to deal with the non-transparent credit culture, said Prime Minister Narendra Modi on Friday.

Addressing a webinar on the implementation of Budget in the financial services sector, Prime Minister Modi said that his government has made reporting of non-performing assets (NPAs) compulsory, instead of sweeping it under the carpet.

“The government’s vision of the country’s financial sector is very clear. It is our top priority that both the depositor and investor experience trust and transparency in the country. Steps have been taken one-by-one to end the non-transparent credit culture in the country. Now reporting of nonperforming assets (NPAs) from day one is compulsory, instead of sweeping it under the carpet,” he said.

He said protecting the earnings of ordinary families, effective and leakage-free delivery of government benefits to the poor, and encouraging investment related to infrastructure for the development of the country are the priorities of the country.

“Looking at long-term financing needs of infrastructure and industrial projects, we’ve built a new Development Finance Institution. Sovereign wealth funds, pension funds, and insurance companies are being encouraged to invest in infrastructure,” the PM stated.

The Prime Minister said that Atmanirbhar Bharat would not just be big industries or big cities, it will be made with the hard work of village, small entrepreneurs in small towns, ordinary Indians.

“Atmanirbhar Bharat will be made up of farmers, units making agricultural products better. Our start-ups and small and medium enterprises (MSMEs) would be the identity of Aatmnirbhar Bharat, that is why special schemes were formulated for MSMEs during the Covid pandemic. 90 lakh micro, MSMEs have received credit worth Rs 2.4 trillion in a push that we provided to them during Covid-19. The government has also opened up the agriculture, coal, and space sector among others for businesses,” he said.

The PM said the Fintech start-ups are doing excellent work in the country today, and they also have a high share in the start-up deals that took place during the Covid-19 pandemic.

“Better help of technology has played a keen role in financial inclusion in the last few years. Today, 130 crore Indians have Aadhar, and over 41 crore people have Jan Dhan Accounts. Over 55 per cent of such accounts belong to women and have nearly Rs 1.5 lakh crore. With the help of Mudra Yojana, loans worth about Rs 15 lakh crores have reached small entrepreneurs in the past years. In this also about 70 per cent are women and more than 50 per cent are Dalit, Tribal and backward class entrepreneurs,” the PM added.